Driving and shark attacks

I was talking to a friend recently and he was complaining that he had been stopped and fined by police for texting and driving. He thought this was unfair. He felt he was in perfect control of the vehicle and presented no risk to himself or others. Later in the conversation (we had moved on to other subjects), he was talking about his summer holiday plans and mentioned he loves the beach but never goes swimming in the sea because of his fear of shark attacks.

Most human beings are not good at taking a rational view of risk. In the above example, we all know that the risk of being attacked by a shark in NZ (or globally for that matter) is vanishingly small whereas, sadly, the chances of dying or being seriously injured in a car crash caused by someone using their phone while driving are much, much higher (and rising fast as people become less and less able to resist touching their phones for more than a couple of minutes).

Attitudes to risk in the financial markets are often similarly irrational. Investors in the stock market are obsessed with worrying about volatility – and that’s a natural reaction. It hurts when values go down, right!?

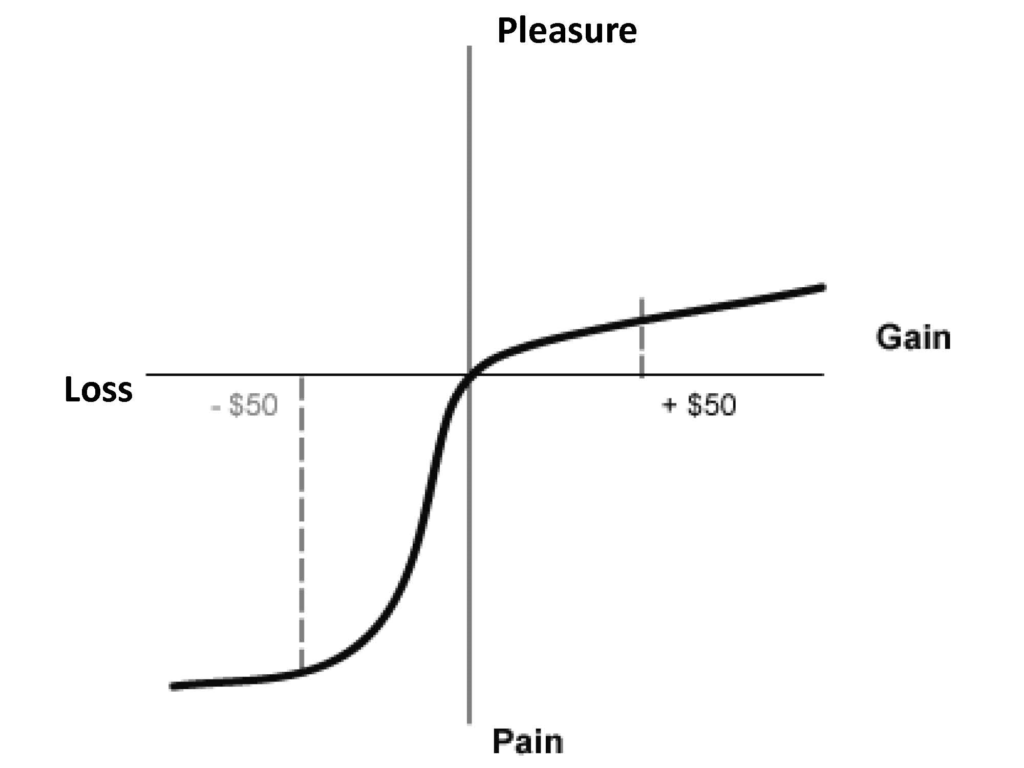

It’s a well-known principle in the financial world that the pain felt from losses can be twice as hard as the pleasure experienced from gains.

Source: Kahneman & Tversky – Research on Loss Aversion.

As soon as markets start to wobble, investors’ immediately start to worry about the next “bear market” and their minds go back to the dotcom bust of the early 2000’s or the Global Financial Crisis.

The risk of not investing

Perhaps the bigger risk is not investing at all. Keeping money in cash over the long term (in savings accounts or term deposits) often does not keep pace with inflation and it is this loss of purchasing power that is the real risk to investors with a medium to long term risk horizon, especially those saving to provide for their retirement. This is true even in these days of low inflation – costs of healthcare and aged care keep relentlessly going up even if the headline rate of inflation stays low.

Keeping money in cash for the long term can lose you money in real terms. I’m not saying don’t hold any cash ever, but one of the best ways to ensure you don’t lose purchasing power is to construct a diversified portfolio invested in a range of asset classes from bonds to equities at a level of risk you are comfortable with. Cash comes into the equation from time to time on a tactical basis and can be used by a skilled, active fund manager to protect the portfolio if required.

Sometimes it’s a good exercise to take a step back and re-assess your attitudes to risk.

Are you more afraid of;

- Shark attacks or heart disease?

- Flying or driving?

- Sky diving or running a marathon?

- Bear markets or loss of purchasing power?

In terms of probability, you are more likely to suffer from the second of these pairings.

If you want to re-asses your attitude to investment risk, you can talk to an Authorised Financial Adviser.