We take a closer look at 5 key drivers that may contribute to long-term inflation.

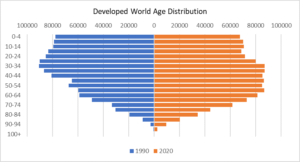

1. Ageing demographics – the median baby boomer turns 65 this year meaning many more will begin to retire in the coming years. This should eventually prove inflationary as more older people leave the developed world workforce in the coming years than younger people enter it. A worker is believed to be a deflationary force as they typically produce more than they consume.

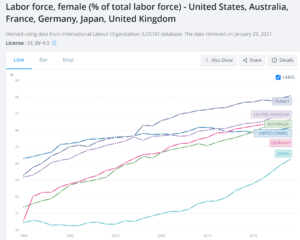

2. Female labour force participation – female labour force participation has increased to about 47% in developed nations from about 43% in 1990. Again, more workers are a deflationary force than China’s rapid relocation of 500 million workers over the last three decades.

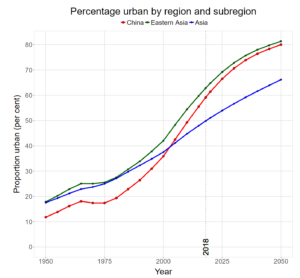

3. Globalisation – perhaps the greatest deflationary force of the last few decades has been the massive relocation of 500 million workers from rural China to cities where they have been integrated into the global supply chain. This urbanisation is nearing its end and countries are now more focused on diversifying supply chains from China or even bringing jobs back onshore. We should still see more deflationary pressures from outsourcing to India, Vietnam and other developing nations. But this is likely to be a far more incremental deflationary force than China’s rapid relocation of 500 million workers over the last three decades.

Source: 2018 United Nations, DESA, Population Division. Licensed under Creative Commons license CC BY 3.0 IGO.

Source: 2018 United Nations, DESA, Population Division. Licensed under Creative Commons license CC BY 3.0 IGO.

4. Fiscal policy – Governments have rediscovered the fiscal policy lever and may prove reluctant to let it go again. Some level of increased fiscal policy may help improve wealth and income inequality which has continued to worsen over the last three decades. This would become an inflationary force.

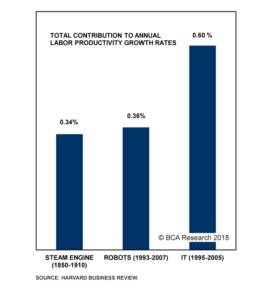

5. Technology – this has been and is likely to continue to be a deflationary force. Improvements in automation have made farming and manufacturing more efficient and new innovative online businesses have improved price discovery, competition, and increased effective capacity in certain industries e.g. Airbnb in accommodation. Technology is likely to continue to be deflationary, although judging the magnitude is difficult.

Conclusion

Conclusion

While many of the long-term drivers of inflation are likely to turn more inflationary over the coming decade, there is no guarantee that inflation will pick up. Perhaps technological developments alone or outsourcing to India can more than offset all the inflationary drivers. Or even if structural inflation does pick up, it may not occur for another five years rather than today. All we can reasonably conclude is that some long-term inflation drivers are becoming more inflationary, and this increases the possibility of inflation over the next decade. But does not guarantee it.