A recent survey by the Financial Services Council titled KiwiSaver at a Crossroads revealed Kiwis are concerned about affording retirement. It showed that around 70% of NZ adults think they may need to work past retirement age. Even more concerning, 65% are worried they aren’t on track to have enough money to enjoy the retirement they dream of, or to be able to afford where they want to live.

For many of us it is difficult to know exactly how much you need to have saved to fund your retirement years. How much is enough? If you don’t know the answer to that question, then how can you plan to get there?

As with many things in life, we need some help and guidance to set us on the right path and keep us on-track. When it comes to KiwiSaver it’s important that you have a goal, and you know what you need to do to achieve it. Whether that’s to use your KiwiSaver savings to help you buy your first home, or a lump sum or amount of income you want to have at age 65. One thing is for sure, having a goal and a plan to achieve it will increase the likelihood of success.

One way to set and reach those goals is to seek advice. That is why just over twelve months ago we launched our online Digital Advice tool to help Milford KiwiSaver Plan members set and achieve their KiwiSaver goals. Since we launched the tool over 6,000 people have used it.

During September we surveyed many of those members and we were very pleased to discover that 88% of respondents said they now feel more confident about being on track towards their KiwiSaver goal. This is very pleasing.

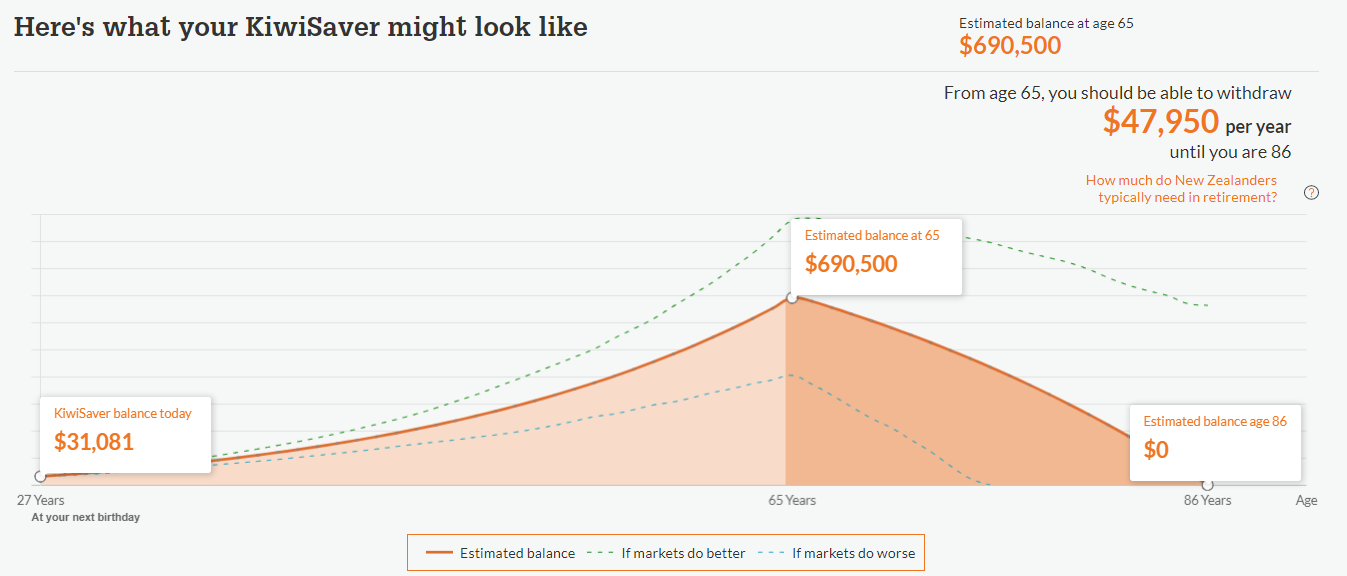

Our Digital Advice tool helps you to set your KiwiSaver goal and then by considering your appetite for risk and ability to save, suggests the appropriate fund and contributions required to reach your goal. It can also help to illustrate how you can spend your hard-earned savings over the rest of your expected life. We also offer Forecast My Balance to demonstrate the potential income a member may be able to draw in retirement. The Forecast My Balance tool can be used alongside Digital Advice to monitor your progress and demonstrate how you are tracking towards your goal. An example of the Forecast My Balance tool is below.

Assumes investment in the Milford KiwiSaver Active Growth Fund, commencing salary of $60,000 as well as 3% Employee and Employer Contributions. Additional standard assumptions in the projection can be found at milfordasset.com/insights/assumptions.

Don’t be one of the 65% of Kiwis who are worried about affording the retirement they dream of. If you don’t have a KiwiSaver goal or aren’t sure if you will achieve the goal you’ve set, then jump onto your Milford client portal or the Milford mobile App and give it a go. It will only take you 10 to 15 minutes, but might prove to be the most fruitful few minutes you ever spend.

For more information about getting advice at Milford, see milfordasset.com/getting-advice